I have a feeling there will be many comparisons to the sinking of the Titanic once Britain hits the ice this winter (together with most western nations, only maybe they are not so connected to the Titanic mythology). Today the official inflation figure enters double digits, wiping out, according to the Telegraph, 16 years of pay growth – which is saying something given the below-inflation rises for most workers since 2008.

A better comparison is the older producer price index, which has hit 17.1%, the highest level since 1977 – but then we had just passed a 1976 peak of 25%, whereas now it is set to increase further, with no obvious end in sight.

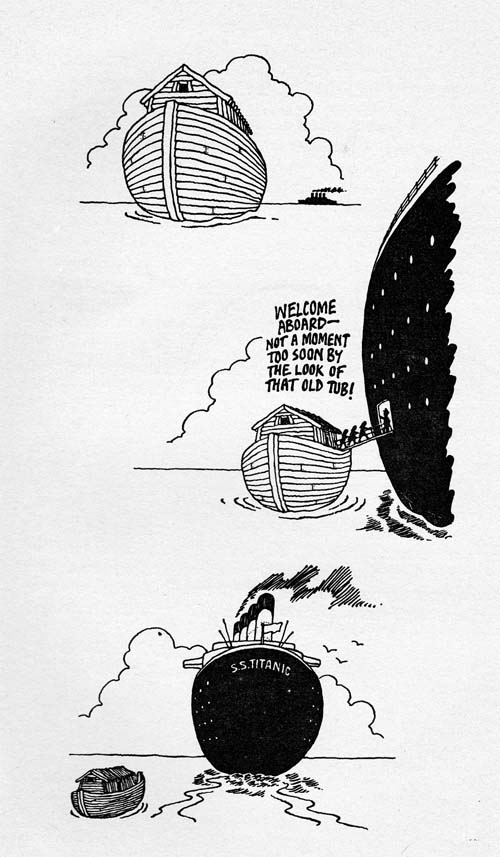

The Titanic hit its iceberg just before midnight, at 22 knots, despite having warnings of sea ice from 9am that morning, and of icebergs since lunchtime. I’m sure most of you have seen the film (which I have not) and probably know more than I do about the mindset that led to these warnings being effectively ignored. By the time the fateful iceberg was seen ahead, turning the wheel hard over and reversing the engines was far too late to avert disaster.

I don’t think there can be much dispute amongst honest people about the main factors that have driven Britain at full speed towards the coming winter’s iceberg. The first is adherence to the same corrupt and unsound financial system that failed us in 2008, was bailed out by the innocent taxpayers because it was too big to fail, and continued in the same vein, only more so, until the Western financial system was brought to the point of collapse (whilst billionaires multiplied). The system, though, still continues apace.

On top of that came the prodigal, and mainly useless, spending on COVID over the last two and a half years, when £5m would have supplied the entire population with Ivermectin. The narrative has actually collapsed, but the vested interests either do not want to accept that or, more importantly, want to keep the truth from the people who have both been harmed, and robbed of their money, jobs, and rights. Accordingly, that damaged engine, too, is kept at full throttle – a new Omicron jab is now going to be offered this winter, to people unable to afford meals, and at their expense.

Thirdly (though earlier in point of time) is the escalation of the climate alarmism scam, which reached its climax in “Net Zeros” and “Green New Deals” during COVID, perhaps because any questioning public voice had been effectively subdued by the emergency powers. COP26 sealed energy shortages into the Western economies.

Lastly, of course, we have the self-imposed sanctions, supposedly against Russia in a proxy economic war, but actually harming only ourselves. These have turned an escalating drama into an acute crisis – which in Britain means, according to some economists, 30% of the population meeting the definition of “poverty” this winter. Such sudden impoverishment is destabilising for any nation, and still more for one whose ordinary population are already experiencing a crisis of hopelessness.

Even now it is probably too late to slam the country’s propellors into reverse and yank the wheel across, but nobody on the bridge is even trying. The retiring Boris Johnson is taking the sun in Greece, and the government says it will start taking action once the leadership election is complete in September. This is the equivalent of the Titanic’s first officer saying, on being told about the iceberg ahead, that the watch is just about to change and that a fresh team on the bridge will make better decisions.

We do need an urgent change of government, but even replacement by the Opposition would give us only more of same. Labour’s Keir Starmer mumbles about capping fuel and other bills, as if bankrupting energy companies is a solution to bad policy. The Conservatives have, so far, printed money to give everyone an insignificant energy rebate, thereby exacerbating the long term problems without doing much in the short term for imminent 200% price rises. PM-in-waiting Liz Truss, meanwhile, sees her priority as sending more treasure and weapons to Ukraine and prolonging someone else’s war there, which means, of course, maximising the self-harm from sanctions. Except of course that it is our citizenry that suffers the real harm of cold and starvation, and not the Prime Minister, just as it is Ukrainians who get slaughtered, and not British politicians urging them to fight on.

I hesitate to mention that all four of the policies most responsible for our plight follow American diktats: our whole political class agrees, if nothing else, that Washington will pull our strings, and so nothing in our electoral system offers a new approach to pilotage of the Unsinkable Ship of State. America itself, of course, is sailing much further to the south, but even that is not ice-free.

If we were serious about implementing effective emergency measures, the first thing would be to abandon sanctions forthwith and make our peace with Moscow. The second would be to ditch the green energy juggernaut, with its subsidies and market skewing, and encourage private investment in real energy infrastructure like nuclear power, North Sea gas and British coal. The third would be to pull back the curtain on the whole Pharma/State Agencies scam and decisively abolish the regulatory systems that channel health and social care in their current harmful paths. Fourthly taxpayers’ money needs to stop going to those whose jobs involve much diversity and inclusion, but no worthwhile product.

And fifthly steps need to be initiated to put our money on a sound footing. But since that would certainly entail abandoning the dollar (and maybe making a gold-based rouble our reserve currency?), there is no way that any of the present political crowd would agree to do it, any more than they would jump ship on the sanctions or admit they were catastrophically wrong on every COVID policy. So let’s hypothesise on a radical (and so far implausible) revolutionary change of government – say the surprise victory of the Reform Party in a snap election, or a military junta complete with lampposts and firing squads. Would that help?

Even then, the Blob occupying our Civil Service and other institutions would either stand in the way of substantial reforms, or be replaced with people having no experience of government (remember how hamstrung President Trump was by his need for an experienced staff that turned out to be largely creatures by the Deep State).

But what is more, we have invested so much treasure and jobs in propping up the lies inherent in our system that reforms must, in the short term, only exacerbate the problems of ordinary people, rather than ameliorating them. If the only decent job you’ve been able to get after your cafe went bust involves pen-pushing a council recycling scheme which, in the end, sends everything to landfill via intermediate “recycling companies” all taking their cut (and all employing underpaid staff), then abolishing that scheme only adds you to the list of the starving.

Academics may, perhaps, deserve to freeze to death for keeping silent when science and economics were abused during the pandemic, but shutting their departments also puts their PhD students, their secretaries and their cleaners on the streets. Even silly sheep deserving scorn benefit nobody by fighting or stealing for food.

In other words, although the only effective action at this stage may be to take to the lifeboats, there just aren’t enough of them, and many are not seaworthy. What I am saying is that, like Jeremiah as the Babylonian scourge approached, we must now get our heads round the inevitability of national catastrophe, imminently, on a scale we have not seen in our lifetimes. Non-Brit readers will recognise similar situations in their own nations, if they follow the real news carefully enough. All the doom-laden predictions are coming home to roost, so that even level-headed people now realise it. To fail to see the iceberg, and understand its full implications, is at this stage as insane as thinking that people really can be born in the wrong body. The problems are becoming too real for mumbo-jumbo.

So the questions we need to be asking ourselves as responsible citizens (and I can’t believe many people reading The Hump are anything else) are firstly, what steps can we take to minimise the harm to ourselves and those we love, from storing food to buying hurricane lamps and jerry cans of fuel, or even thinking of what other jobs might survive the crunch? And secondly, is there anything we can usefully do to help others once the ice hits the ballroom?

I’m thinking here largely of those who are Christians in churches, because we are already accountable to a close community, many of whose members are likely to be hit hard even if they are beginning to read the writing on the wall. When disaster strikes us all, whether in First Class or steerage, and when church funds are as vulnerable as any individual’s deposit account at Barclays, then how do we avoid scrabbling to get ourselves the last place in the boat whilst battening down the hatches on the people below decks? What should be the action of those lucky enough to keep a job that, almost, covers the energy bills and some food, towards their brethren who are less “fortunate”?

Answers on a postcard, please. Preferably before October.

Jon,

A few notes, after reflecting on your post:

This month former prime minister Gordon Brown said that stripping the Bank of England of its independence would be a “very bad mistake”. This is the man who between 1999 and 2002 was responsible for the sale of 58% of the UK’s 715 tonne gold reserves at a time when gold prices were at their lowest for 20 years. The average price of gold then was $275 per ounce. Today gold sits at $1,769 per ounce, a 479% increase over the last 20 years. It might be said that he couldn’t have foreseen that this would happen. Maybe not in detail, but he should have known the history of this precious metal as a good long-term investment, and that 50 yrs ago (1972) gold sold for $50 per ounce.

Perhaps Gordon Brown is also wrong about the Bank of England. Some would say that it is not really ‘independent’ because the Chancellor of the Exchequer and the Treasury have the power to over-rule it, indeed instruct it. So why the label ‘independent’?

Either way, whether Bank of England is regarded as ‘independent’ (which is the way the general public see it) or it is regarded as a puppet of the Government (which is how it works in practice), we should be clear that the policies of ultra-low interest rates and quantitative easing (flooding the market with new ‘printed’ money) since the 2008 financial crisis are the consequences of Government policy.

Whilst I confess to being a relative novice in financial matters, I can see some of the down-sides to low interest rates, not least i. the increase in personal, corporate and national debt, ii. increase risk-taking, iii. reduced incentives to save, iv. price inflation.

So now at every level of society we have spent more than we have earned. UK inflation is in double digits and the worst in the G7. Prices are rocketing and our money has been devalued. Average energy bills are predicted to reach £5,456 by next April. The Bank base rate may reach 3.75% by 2023, which is not historically high but will be very painful for those who have over-reached on the borrowing, especially those on current or pending variable mortgage rates.

We reap what we sow. There’s no free lunch.

Too true, Peter. And the value of gold would be even higher if the price weren’t rigged by financiers playing with paper gold the same way they play with money itself, in order to prop up the perceived value of the unbased dollar (and, I guess, the pound).

That’s another thing the new “eastern” system is redressing in its own sphere – money based on gold, traded at its true value. There’s a novelty.