Do you remember the fad, around the 1990s, for makeover programmes of one sort or another? It began with Ground Force, the garden makeover programme that decimated suburban wildlife under hundreds of square miles of decking, and promoted Charlie Dimmock into a “prominent” celebrity.

But it was soon followed by Changing Rooms, with double-barrelled dandies applying the decking inventively to your friend’s living room wall, and by a plethora of “me too” variants, making over your failing restaurant, your dog, and anything else not already decked over.

The common features of these entertainments were a team of supposed experts, main qualification a good on-screen look, arriving in some trademark vehicle, doing the decking bit over three days, and revealing the result to the shocked delighted owners.

I suspect that the genuinely creative idea that lit the flame for unoriginal imitators to pitch their ideas was the archaeology programme Time Team, which from 1992 used the “three day Flying Squad” approach with real archaeologists both to popularise the science and do some genuinely useful pilot digs.

But as for me, seeing that we had reached a period when the minimal inventiveness of picking something else to make over was enough, I suggested to my friends that we ought to make a pitch to the BBC for Changing Tombs, in which a team of celebrity undertakers would drive around the country in a vintage hearse to transform your mundane family leave-taking into something original, impactful – and of course infinitely tacky. You can imagine the sepulchral, though oddly photogenic, Jeremy Gwynnedd-Brown filmed in a municipal cemetery, saying airily, “Mmm – I feel something Gothic coming on…”

Alas, my award winning series was never to be, for of course the bottom soon fell out of the saturated makeover market – not to mention the rotting decking – and it is now only weakly represented by daytime re-runs of Antiques Road Trip.

My daughter, though, who seems to have inherited my warped sense of humour, recently came up with her own “series proposal” based on the more current fashion for programmes researching the genealogical history of celebrities, first manifested in Who Do You Think You Are?. But rather than going over the well-trodden ground of discovering trivial stuff, like the grandfather of some mediocre actress being a serial killer (my own grandfather was a bigamist and a serial liar, so what’s the big deal?), my daughter has a better idea.

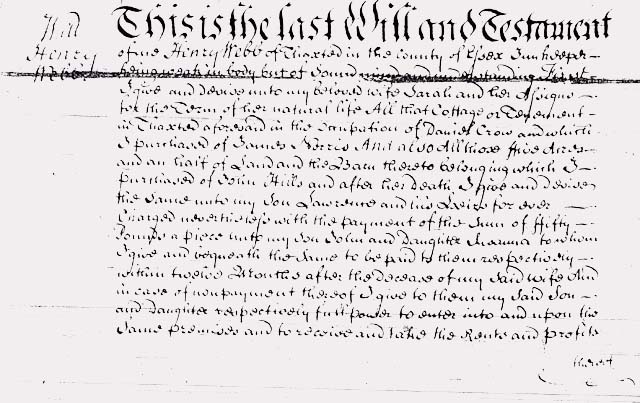

Her blockbuster was to be called Where’s My Stash?, and although incidentally using the census and registration records, it would focus on the far more interesting information held in the Probate Records. Most families have from time to time wondered whatever happened to all the dosh that their rich great-grandfather William accumulated, and more relevantly, how come none of it came to them? Where’s My Stash would have a team of celebrity probate experts (they might travel around in a Tesla Model X, but that’s not crucial), firstly doing the fascinating paperwork on copper-plate legal documents, and finally driving to Basildon with the disgruntled clients to confront the purloiner of the inheritance in his grandiose new-build mansion.

The programme would end with the continuity guy saying, “Since Derek Shift refused to give Betty and Simon the £4 million pounds due to them, they have now started legal proceedings. We’ll let you know how they get on.” Perhaps, five years or so later, a retrospective episode could revisit Betty and Simon, in best Grand Designs manner, and find them still embroiled in Dickensian litigation that has bankrupted both them and Derek Shift, and broken up their marriage. It would all be highly entertaining, engaging with the best British traditions of fair-play and envy.

But unfortunately such a series would never take off, not (as with Changing Tombs) because the genre-mine has become worked out, but because nearly every episode would discover that their relative’s pile was not in the hands of some Chav in Essex, but had disappeared into the anonymous coffers of the government and their corporate friends, who for decades have been operating the biggest Ponzi scheme in the history of man, to enrich the richest at the expense of everyone else.

We all immediately think of Income Tax and Inheritance Tax depleting potential bequests. Also, with so many still, for the moment at least, living into old age the costs of care homes force people not only to relinquish their savings and heirlooms, but sell their war medals too. When people say, “Why should the State pay for your end of life care?” one legitimate reply could be, “because the State has taken most of my life’s earnings in taxes to pay the Military Industrial Complex for needless wars and to turn the NHS into a failed bureaucratic state religion.”

But we now have to factor in the way inflation has been increasingly used to transfer wealth from the people to the money printers. When governments and banks lend you money for your mortgage or business loan, they conjure it up as new money from nowhere with a few computer keystrokes, but claw it back through your real goods and services. You didn’t imagine they actually had the money to lend already, did you Silly? Should you default, they get your house or business, real assets, in exchange for those few keystrokes. You pay with your labour – they pay you with IOUs. Nice work if you can get it, and you can get it if you are a central bank.

But creating all this merely notional money, when the real resources and assets of the nation remain unchanged, is simply debasing the currency. If the GDP was worth £2.23 trillion in 2022, and lenders print another 2.23 trillion whilst the real goods and services remain more or less the same, the GDP will be £4.46 trillion, but any money you have saved will buy only half of what it did. Not only “quantitative easing” but the entire financial system, based on generating currency for debt, is pure theft. And like all Ponzi schemes, it is heading for collapse in the not too distant future. Look out for starving people wheeling digital cash around in their iWheelbarrows.

So as the elderly will-maker lives out his last years on his earned capital, the care costs will increase logarithmically as the real wealth is concentrated in the hands of the money-printers. When his relatives die and, perhaps, sell a rental property he owned, the “Capital Gain” that’s taxed will not primarily reflect increased wealth, but inflation of property prices. The money left after the sale will, in real terms, be less than the man paid out to buy the asset in the first place.

The COVID period was characterised by South-Sea Bubble contracts being issued profligately by governments for vaccines, PPI, testing, furlough-payments etc, and paid for by issuing more debt (that is, by conjuring IOUs out of thin air). The result was the largest transfer of wealth from the poor to the very rich in history, across the world. Whether that was sheer economic incompetence (Bank of England pundits claiming that printing money does not cause inflation, Ursula von der Moron claiming that the resultant rampant inflation “came out of nowhere”) or, as many suppose, part of a deliberate agenda to bring about Universal Basic Income and Central Programmable Digital Currencies to make us totally dependent on the State, the result is the same. “You will own nothing, and you will certainly leave nothing to your descendants.”

For some of us with working-class ancestry that maybe will make little difference. I inherited nothing from my parents except my Dad’s two saxophones, which still make excellent music and are a living link to him, a true legacy. Still, I’d rather leave the fruits of upward social mobility to my children than to Bill Gates or Black Rock. And besides, where will the spice of life be if you know in advance that the money Auntie Alice, who owned half of London, isn’t waiting for you in a bank vault somewhere, but went like everything else into the coffers of the banker?

An interesting interview here which I only saw today, but which covers what I say above on money, from an expert.

I was particularly struck by his assertion that they elites who are running the financial system into the ground through inflation can currently be compared to someone planning to move abroad, and buying everything for his new life on hire-purchase knowing that he’ll not be paying for it.

And so you can see COVID and the Ukraine War as last-ditch efforts to maximise their tangible assets by money-laundering on an epic scale, for when the new CBDCs come in. All the debt they have built up by printing the money for vaccines, missiles, etc, will fall on you and me, whose pensions government will not be able to afford to pay from their now-worthless gilt-edged bonds. Far-fetched? Maybe, and Epstein killed himself, too.

The only game in town now, says the expert, is wealth-preservation through buying precious metals. That indeed is what the central bankers are surreptitiously doing, whilst they manipulate the gold and silver prices downwards to get it cheaply for themselves whilst persuading ordinary people that it’s a poor investment.